Singapore is now the world's fourth-largest international financial center, behind New York, London, and Hong Kong, according to the 2018 Global Financial Centers Index (GFCI) study. Establishing a BVI company bank account in Singapore offers numerous strategic advantages for entrepreneurs and businesses alike. This article examines the intricacies of this process, exploring the steps involved, the associated benefits, and the financial considerations.

Overview of BVI company bank account in Singapore

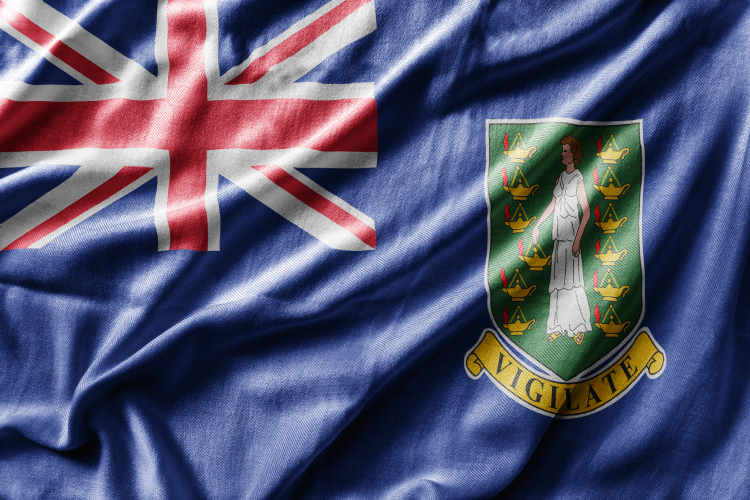

About BVI

Nestled in the heart of the Caribbean, the British Virgin Islands (BVI) is renowned not only for its stunning natural beauty but also for its thriving economy and robust financial sector. As a premier offshore financial center, the BVI offers a myriad of investment opportunities for individuals and businesses seeking to capitalize on its favorable business environment, strategic location, and attractive tax regime.

The British Virgin Islands (BVI) possesses a well-regulated financial services sector, overseen by the BVI Financial Services Commission. This regulatory supervision encompasses various financial activities, such as banking and insurance, ensuring the industry's integrity and stability.

BVI company bank account in Singapore

The BVI's global standing as a leader in international finance can be attributed, in part, to the enactment of the International Business Company Act in 1984. This legislation has cemented the BVI's status as a significant international financial hub, attracting businesses worldwide. Regarding banking, the BVI exercises stringent control over bank licensing. Consequently, the jurisdiction currently hosts six commercial banks and one restricted licensed bank.

5 Compelling reasons to open BVI company bank account in Singapore

With 5 compelling reasons you can consider to open a company bank account, they include:

- Convenience: The process of opening a business bank account in BVI is streamlined and does not require personal visits or signatory travel. This eliminates the need for physical presence, making it convenient for businesses to establish banking relationships.

- Reasonable Deposit: BVI banks typically ask for a reasonable deposit for offshore bank applications. This reduces the financial burden on businesses, especially startups and small to medium-sized enterprises, and makes banking services more accessible.

- Fast Approval: The BVI banking system is known for its efficient approval process. Businesses can expect a prompt response when applying to open a business bank account, enabling them to swiftly commence their operations and manage their finances effectively.

- Versatility: Whether your company is involved in trading, consulting, or functioning as a holding company, opening a business bank account in BVI is straightforward. The system offers flexibility and convenience of use while accommodating a wide range of corporate tasks.

- High Reputation: BVI companies have a strong reputation, which is advantageous when working with Electronic Money Institutions (EMIs). These institutions often prefer partnering with BVI companies because of their solid standing and credibility in the international business community.

Benefits of setting up a BVI company

While many jurisdictions share common advantages such as the use of the English language, absence of currency exchange controls, and adoption of the US dollar as currency. Here are 14 benefits of setting up a BVI company:

- Taxation: BVI companies enjoy a favorable tax regime with no income tax, corporation tax, capital gains tax, or wealth tax. Utilizing a BVI company as an intermediary holding company can create tax-neutral layers within the corporate structure, providing opportunities for tax optimization.

- Speed: BVI companies can be swiftly incorporated through licensed registered agents using the BVI's online electronic interface, usually within two days, subject to meeting necessary KYC requirements.

- Names: BVI companies can be incorporated with foreign character names (e.g., Chinese names) in addition to their English names, offering flexibility in branding and representation.

- Cost: In comparison to mid-shore countries like Hong Kong or Singapore, as well as other upscale jurisdictions like Cayman and Bermuda, BVI businesses are more affordable. A normal BVI company's incorporation will set you back about US$1,750, all expenses included.

- Confidentiality: The BVI ensures corporate confidentiality by not requiring public filing of the register of directors or the share register of a company, while still maintaining safeguards against money laundering and international crime.

- Corporate Flexibility: BVI company law provides maximum flexibility, allowing companies to undertake any lawful act or activity without strictures regarding corporate benefit. The economic substance regime mandates entities to maintain adequate substance in the BVI.

- Capitalization Requirements: The BVI does not impose "thin capitalization" rules or general maintenance of capital requirements, providing flexibility in distributing assets to shareholders through dividends and empowering companies to provide financial assistance for acquiring their own shares.

- Joint Ventures: BVI companies can adopt provisions in their corporate constitutions to abrogate the common law duties of directors in joint ventures, making them an attractive choice for structuring international joint ventures.

- IPO Ready: BVI companies are commonly used as listing vehicles in international capital markets, with shares listed on major stock exchanges worldwide.

- Debt Financing: BVI offers a simple system for secured creditor registration, facilitating asset leveraging when necessary to raise capital, and has a well-developed insolvency system crucial for banks considering funding.

- "Light Touch" Regulation: BVI companies generally do not require regulatory approval, apart from specific industries such as investment funds, banking, and insurance. The BVI seeks to reduce needless burdens by implementing "light but effective" regulations.

- Innovative Trust Structures: BVI trust law has been modified to remove uncommercial common law provisions, driving the popularity of trusts with innovative products like VISTA trusts and private trust companies.

- Commercial Court: The BVI Commercial Court efficiently handles company and commercial disputes, delivering high-quality judgments within an accelerated time frame, with appeals to the Privy Council in London.

- FinTech and Cryptocurrency: The BVI has become an attractive jurisdiction for FinTech and cryptocurrency transactions, encouraging development within a light-touch regulatory environment through initiatives like regulatory sandboxes.

Setting up a BVI company in Singapore

Setting up a BVI company in Singapore is a straightforward process that combines the advantages of both jurisdictions. The first step is to engage a reputable corporate service provider with expertise in offshore company incorporation. They will guide you through the necessary steps while ensuring compliance with local rules and regulations.

Setting up a BVI company in Singapore

Step 1: Preparing to establish a BVI company in Singapore

To begin setting up your BVI company in Singapore, Singaporean residents can contact our office via various communication channels, including email, phone, website, or by clicking the following link: https://www.oneibc.com/sg/en. Our experienced advisory team will assist you in selecting the appropriate type of British Virgin Islands (BVI) company for your business activities. They will also verify the eligibility of your preferred company name and provide information on the United Kingdom's obligations, taxation policies, and financial year.

Step 2: Selecting the type and services for your BVI company

Choose the most suitable entity type for your business objectives and consider opting for recommended services for your BVI company. These services may include:

- Setting up a bank account

- Nominee services

- Serviced office solutions

- Intellectual Property (IP) and Trademark registration

- Setting up a merchant account

- Bookkeeping services

Our team will help you understand the benefits and relevance of each service option to ensure they meet your specific requirements.

Step 3: Payment and ownership of your preferred BVI company

You can move on with the payment procedure when you have completed your choices and the services you want to use.. Upon completion of the payment, you will gain ownership of your chosen BVI company, enabling you to confidently commence your business operations.

In summary, the process of establishing a BVI company in Singapore involves three key steps. Initially, our advisory team assists with preparation, including selecting an appropriate BVI company type and providing essential information. The second step entails choosing desired services tailored to your business needs. The third and last step is to pay the required amount to formally create and acquire your chosen BVI business.

BVI company setup cost in Singapore

The expenses associated with establishing a BVI company in Singapore are influenced by various factors, including professional fees, government charges, and continuous maintenance costs. It is crucial to collaborate with a reliable corporate service provider who can offer a clear breakdown of these expenses. Generally, the BVI company setup cost in Singapore may include:

- Incorporation Fees: These fees cover procedures for registering the BVI company in Singapore, including document preparation, government charges, and administrative expenses.

- Corporate Service Provider Fees: Engaging a corporate service provider ensures a seamless incorporation process and ongoing compliance. Their fees encompass professional guidance, document preparation, and support for administrative tasks.

- Registered Office and Secretary: A registered office and secretary are mandatory requirements for a BVI company in Singapore. Costs for these services may vary depending on the provider and office location.

- Annual Maintenance Fees: Ongoing compliance obligations involve additional costs, such as filing annual returns, preparing financial statements, and paying filing fees.

Consulting with a reputable corporate service provider will provide a detailed breakdown of the costs specific to your BVI company setup in Singapore. They can help you navigate the procedure and guarantee that all applicable laws are followed.

To conclude,

In conclusion, setting up a BVI company bank account in Singapore offers a compelling proposition for entrepreneurs seeking to expand their global footprint and optimize their business operations. By leveraging the advantages of Singapore's robust regulatory framework and the tax efficiency of a BVI company structure, businesses can unlock new opportunities for growth and prosperity in the dynamic landscape of international business. With careful planning, strategic execution, and the guidance of experienced professionals, entrepreneurs can embark on a journey of success and achieve their business objectives with confidence.