- Notifications

We will only notify the newest and revelant news to you.

In today's global business landscape, International Business Company (IBC) plays a pivotal role in facilitating cross-border transactions and expanding business horizons. However, before delving into the realm of international commerce, understanding the IBC registration process is crucial. Besides, Seychelles, a jurisdiction renowned for its favorable regulatory environment and pro-business policies. With its streamlined IBC registration process and accommodating legal framework, Seychelles offers a compelling destination for entrepreneurs and corporations alike. This article provides a comprehensive guide to IBC registration in Seychelles jurisdiction , covering its requirements and the step-by-step process involved.

Benefit of choosing Seychelles for IBC registration

Seychelles imposes specific prerequisites for International Business Company (IBC) registration, essential for businesses and entrepreneurs aiming for a successful registration process. Familiarizing oneself with these requirements is paramount to ensure a seamless and efficient registration procedure.

Seychelles extends IBC registration eligibility to both individuals and corporate entities without nationality or residency restrictions for directors, shareholders, or beneficial owners. This inclusive approach renders Seychelles a highly accessible jurisdiction for international business ventures. Furthermore, while IBCs are generally unrestricted in the types of business activities they can undertake, certain regulated sectors such as banking and insurance necessitate additional licensing.

The Articles of Association delineate the internal rules and regulations governing an IBC's operations in Seychelles. This document typically encompasses particulars regarding the company's objectives, share classes, voting rights, and decision-making procedures, and is obligatory for submission during the registration process.

The Memorandum of Association, another crucial document for IBC registration, provides pertinent details about the company, including its name, registered office address, authorized share capital, and share particulars. It serves as the company's constitutional framework, outlining its legal structure.

Every IBC in Seychelles must appoint a registered agent and possess a registered office address within the country. The registered agent assumes responsibility for ensuring the IBC's compliance with statutory obligations, while the registered office address serves as the designated location for official correspondence and legal documentation.

As part of the IBC registration process, comprehensive information about the company's shareholders and directors must be furnished. This encompasses their names, addresses, nationalities, and contact particulars, with shareholders and directors eligible to be either individuals or corporate entities.

In alignment with Seychelles' commitment to combat money laundering and enhance transparency, IBCs are mandated to maintain records of their beneficial owners, typically encompassing individuals who own or exert control over the company. While this information remains non-public, it must be accessible to the Seychelles Financial Intelligence Unit (FIU) to ensure compliance.

In Seychelles, there are no stipulated minimum capital requirements for IBCs. This flexibility presents an appealing option for businesses seeking to establish a corporate presence without the burden of significant initial capitalization. IBCs have the liberty to issue shares with varying par values or even in a currency of their preference, thereby enhancing their financial adaptability.

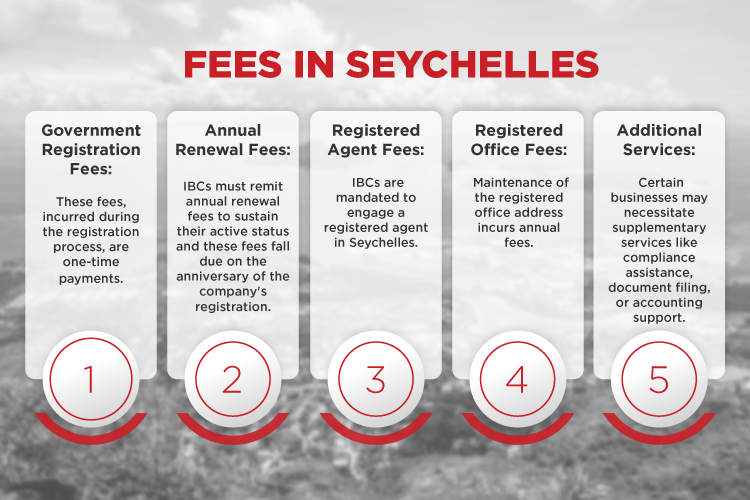

The expenses associated with IBC registration in Seychelles are relatively reasonable, rendering it an enticing choice for businesses of diverse scales. Nevertheless, it's imperative to be cognizant of the accompanying fees and costs, which may encompass:

Fees and Expenditures

It's essential to recognize that while Seychelles presents a cost-efficient registration process, businesses should also account for ongoing maintenance and compliance expenditures to uphold their financial obligations and regulatory compliance. Additionally, the cost framework may vary contingent on the specific service providers engaged for registration and ongoing assistance.

IBC registration requirements in Seychelles offer a direct and accessible avenue for businesses and entrepreneurs seeking to capitalize on the jurisdiction's tax benefits, confidentiality provisions, and operational versatility. Grasping these prerequisites and the associated financial considerations is imperative for a successful registration endeavor and sustained adherence to regulatory standards.

Registering an International Business Company (IBC) in Seychelles entails a well-defined process crafted to be efficient and accommodating to businesses. Below is a comprehensive breakdown of the IBC registration process, encompassing initial steps through post-registration compliance obligations.

The outset of the IBC registration process involves selecting and securing a distinctive name for the company. The chosen name should not mirror any existing entity in Seychelles, preserving each IBC's unique identity.

Every IBC in Seychelles must designate a registered agent. Serving as the liaison between the IBC and government authorities, the registered agent ensures compliance with statutory obligations and maintains a presence in Seychelles. Their pivotal role extends to ongoing operational and compliance aspects of the IBC.

Following the preliminary steps, the subsequent phase entails compiling and submitting requisite documents to the Registrar of International Business Companies in Seychelles. Key documents include:

Once the documentation is submitted, the Registrar of International Business Companies undertakes a meticulous review of the application. This involves scrutinizing the completeness and accuracy of the provided information and documents. Any requests for additional information or clarifications may be made during this phase.

Upon successful review and approval, the Registrar issues a Certificate of Incorporation, formally acknowledging the IBC's status as a legal entity in Seychelles. This certificate serves as conclusive evidence of the IBC's establishment and registration.

Following the acquisition of the Certificate of Incorporation, adherence to ongoing requirements is imperative for the IBC to maintain active status and leverage the jurisdiction's benefits.

IBCs must submit annual returns to the Registrar of International Business Companies, featuring updated information concerning shareholders, directors, and the registered office address. Timely submission is vital to avoid penalties or potential de-registration.

Maintaining accurate financial records and comprehensive transactional documentation is obligatory for IBCs. While specific requirements for financial audits may not exist, robust accounting practices are essential to fulfill tax and compliance obligations.

Despite Seychelles' favorable tax landscape, IBCs must meet tax obligations, including prompt payment of annual renewal fees and any applicable taxes or fees. Additional tax duties arise if the IBC engages in business activities within Seychelles.

The IBC registration process in Seychelles is meticulously designed to offer simplicity and accessibility to businesses and entrepreneurs seeking a jurisdiction with advantageous tax policies and operational flexibility. Comprehending and adhering to pre-registration and post-registration requirements are pivotal for a successful and compliant IBC registration in Seychelles, enabling businesses to fully capitalize on the jurisdiction's benefits.

Latest news & insights from around the world brought to you by One IBC's experts